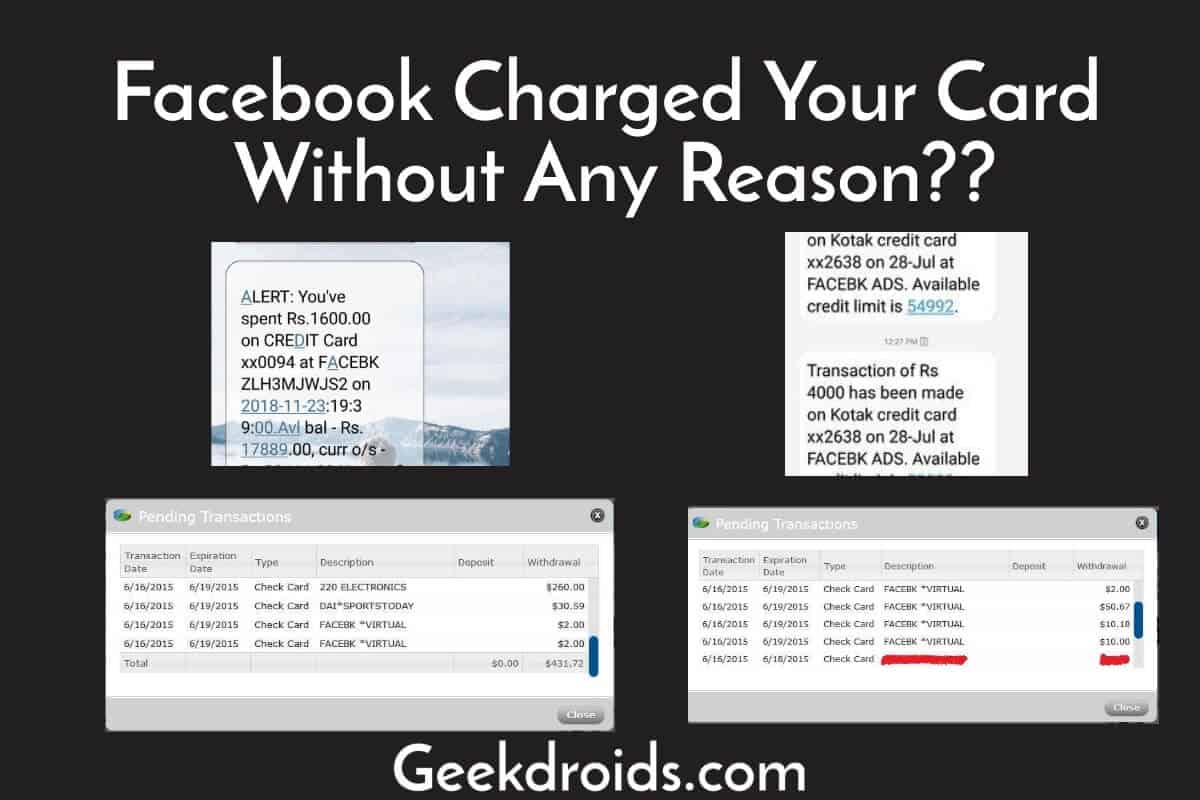

Did you suddenly notice a suspicious charge in your Credit Card or maybe in your bank account statement that claims it was charged by FACEBK? In your statement, you might have noticed something like facebk virtual goods fb.me/cc, facebk fb.me/ads irl, facebk fb.me/cc ca, or something written as or related to Facebook like the ones in the image below and you don’t recall doing any transaction on Facebook?

What is FACEBK on your bank statement?

Page Contents

The charge that you are seeing on your statement is most likely a charge from Facebook Ads, as it is the only service which Facebook charges money for. If you don’t remember using your card on Facebook for running ads, then it’s highly likely that your card details were stolen and it was used by someone else to commit fraud and fund their Facebook Ads account.

Facebook is a free platform to its users but it is supported by ads from advertisers. It is estimated that Facebook has around 1.39 Billion monthly active users. To support this mammoth number of users, it needs a good amount of revenue to keep running, which it does from the ads which are being run by advertisers on the platform. It was estimated that Facebook ad revenue was around at 12.47 Billion Dollars in 2014. Handling operations at this major scale can be overwhelming at times with so many advertisers and users joining their platform every day, it is very easy for scammers and hackers to quickly bypass their security systems and misuse it.

Read Also: When did I join Facebook?

Why do you have Facebook charges on your credit card?

If you are seeing a charge from FACEBK on your card and you have not setup and run any ads on Facebook, then your card details have been leaked and were used by someone else to run ads on Facebook or to simply add the card to their Facebook ad account.

How to get your money back?

There are a few ways in which you could try getting your money back –

- First, contact your bank or credit card issuer and inform them about the fraud charge on your card or account.

- Most banks and credit card companies have online forms for reporting fraud transactions. Just Google your ‘bank name + report fraud’ or ‘credit card issuer name + report fraud’ and you should be able to get to the page from where you can report the fraud transaction.

- If you couldn’t find any online form to report the fraud transaction, then immediately call your bank’s customer helpline and report it to them.

- Then contact Facebook through this official form, disputing the charge and also informing them about this fraudulent charge.

- Then you must have your credit card replaced as it is very clear that your credit card information was stolen, which led to this fraud charge on your card. To prevent further fraud charges its better to dispose and block this card and get a new one.

How to prevent further suspicious transactions?

In the future, to prevent any kind of fraudulent transactions ensure these steps –

- Firstly you are getting your current card replaced by contacting your bank.

- Opt for Banks and credit card providers who use 3D Secure(which is a 3 domain structure also known as payer authentication and it is a security protocol which helps in preventing fraud online transactions).

- Avoid using your cards on less secure websites. If the Paypal payment method option is available then use that as when you are paying through Paypal, no sensitive payment information is being stored in those websites. Your data is only being stored by Paypal, which uses great security measures and is a very secure platform.

- Turn off international transactions on your cards and only turn it on when you need to use your card on an international website. This surely helps me in preventing a lot of fraud transactions and also helps me in notifying if my card details have been leaked. When this option is turned off, then all transactions from a foreign point of sale or e-com websites are rejected. And your bank also informs you when a transaction is being rejected and from where, so you can safely remove it from that website or report the website about it.

- Opt for one-time use disposable cards, if you are doing a one-time transaction on a website that you don’t trust. These cards usually get cancelled after one use and you have the option to allot a certain amount to the cards to spend.

How do you dispute a Facebook charge?

You can fill up this official form to dispute the charge with Facebook but it won’t be of much use. It would be much better to immediately contact and inform your bank or credit card company about this unauthorized charge on your card so they can take the necessary steps.

Also if you are annoyed by friend suggestions from Facebook, learn how to stop friend suggestions on Facebook?

3 thoughts on “FACEBK fb.me/ads charge on Credit Card? Solved here”

does following this will get my money back?

Yes but you will still have to inform your credit card company or bank about this on order to get the money back.

Thanks for the feedback, trues happens on the same date as you put on this website. I only manage to find out after a week. Some of the transaction gone through amount to $100 in 2 parts. Left a dollar still pending, however i still contact the bank. Happens twice with me, once someone manage to scan my card and the bank replaced a new card and disable auto scan system. And now after purchase item via FB via Paypal but they do manage to know my CC number. I trace back to Paypal but no transaction was make, very intelligent hacker. But now i have to install anti virus hacker to my phone and change password again as second security and safety measures.